8/28/2017 9:58:00 AM CEST Add a Comment

Using the patterns list

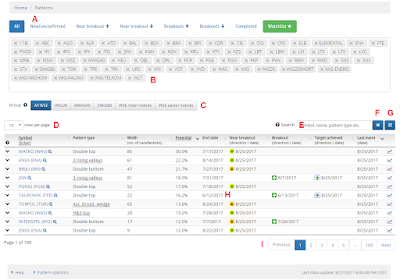

This post describes the usage basics for the ATmatix

patterns table. It is the most important part of the application. The list allows you to browse, search, filter and sort the patterns that have been automatically detected by our algorithms.

FILTERING

In the upper part of the web page, you will find the filtering buttons (tabs) that narrow the data view to patterns that are in a certain state – the tabs list is marked as A in the picture below:- All (without any filtering - all pattern states)

- New/unconfirmed – restricts the view to patterns which didn’t have breakouts yet; they may however be “close to upward breakout” or “close to downward breakout”

- Near upward/downward breakouts – restricts the view to patterns close to breakout, but without the actual breakouts,

- Upward/downward breakouts – narrows the view to patterns which had breakouts, but the target price after a breakout has not been yet achieved,

- Completed – limits the view to patterns for which the target price was reached.

There is also the additional “ Watchlist” button, which narrows the view to the assets that were added to the user’s favorites list. This button may be in enabled or disabled state and is visible to logged-in users only.

You can see the Watch List below the filtering tabs (marked as B in the picture). In order to add the stocks or indices to the list, you need to click (or tap) the list and type in at least 2 characters, to see the dropdown list with asset names that match the entered string.

After the entry is chosen from the list, it will be added to your Watch List. Attention: if a chosen stock has already been on the Watchlist and is chosen again, it will be removed from your Watch List.

To manually remove an asset from the Watch List, click the “x” button located next to the symbol in the list. You may also use backspace key to remove the last element from the list.

Clicking (or tapping) the symbol (but not the removal button of course) will narrow the content of the patterns table only to the selected asset.

SYMBOL GROUPS FILTER

Below the Watch List, there are buttons additionally limiting the pattern list only to stocks that belong to a certain group (marked as C in the picture above).

Currently, the available groups are:

- All (no narrowing) – all the patterns are visible (albeit the state filtering still apply, of course),

- WIG20, MWIG40, SWIG80 – only stocks listed in the selected index,

- Main indices – only the patterns for the main WIG indices (WIG20, WIG20SHORT, WIG30, MWIG40, SWIG80, WIG etc. FW20 futures are also included in this group),

- Sector indices – only the industry indices, such as: WIG-energy, WIG-oil&gas, etc.

TABLE VIEW

Below the Watch List, you will find the patterns table (marked as H in the screenshot).The table is divided into pages, with max. 10 rows per page as the default. To change the number of entries per page, use the dropdown list (marked as D).

In the lower part of the list, there are navigation icons allowing you to move between pages (previous, next, page numbers) – marked as I in the picture.

Below the table, you can see the date of the last data update. The data is updated daily, after each WSE trading session ends.

The pattern list has the following columns:

- Symbol/Ticker

- Pattern type

- Width (the number of sessions – or candlesticks – wthin the pattern, since the starting point of the pattern until its endpoint)

- Potential – this is the range of the expected post-breakout price movement, calculated in accordance with the measure rule for a given pattern type, with the assumption of the anticipated (yet not 100% sure) breakout. The detailed information on target range measurement methods will be posted on the blog some time in the future. We have to mention that the value of the potential is being updated twice: right after the pattern detection and after a breakout (upward or downward) takes place.

- Detection date – this is the day on which the pattern has been detected by ATmatix (also the date of the pattern’s end-point),

- Near breakout – this is the last (newest) date of the price being close to the breakout level (upward or downward). Up or down arrow suggests the hypothetical breakout direction.

- Breakout – the date of the actual breakout. The breakout can be the pattern’s confirmation or invalidation, depending on the type of the pattern, i.e. upward breakout is a confirmation for bottom patterns. The arrow suggests a breakout direction.

- Target reached – the day the price has met the breakout target price range, previously set by ATmatix. It means that the pattern was completed on that day.

SORTING

Data are sorted by default by the value of two columns: the date of the last event (in descending order) and the pattern potential (also in descending order). Depending on the choice of the tab (new, near breakout, breakouts, etc.) the default sorting changes into:- Detection date (descending order), potential (descending) – for the “new/ unconfirmed” tab,

- Near breakout date (descending order), potential (descending) – for the “near breakout” tabs,

- The date of the breakout (descending order), potential (descending) – for the “breakout” tabs,

- The date of reaching the target (descending order), potential (descending) – for the “completed” tab.

To restore the default sort order, use the button located on the right of the search box – marked as G in the picture.

SEARCHING

In the upper side of the table, you can find the search input box – marked as E in the picture. The search engine allows you to find information according to the certain criteria. Type at least 2 characters – you don’t need to enter the whole name, ticker or symbol, but a fragment is just enough.You may type:

- A symbol, ticker or stock/index name. After typing at least 2 first characters the drop down list of the matching names opens.

- You don’t have to choose the name from the list, as the filtering works immediately after typing a part of the name. If you decide to choose the name from the list, then the search results will be limited to that chosen asset.

- Type of pattern – you can type a part of the pattern’s name (e.g. “wedge”, “bottom”, etc.)

- The rest of the data visible in the table, such as pattern width, the potential, detection date, near breakout date, breakout date, and so on.

- ".WIG" (“.” in front of the name) narrows the results to the names starting with WIG)

- "W20." (“.” following the name) restricts the table content to the names ending with W20

- “.WIG.”(“.” In front of the name and following the name) narrows the results to the exact name (WIG only).

PATTERN DETAILS

On the left side of each row in the table, there is a button that expands the pattern details (you can also double click on the row, to expand it, or – in the mobile version of the page – just tap it once).

Details include:

- Name/type of the pattern

- Upward/downward breakout statistics (displayed only for the patterns for which a breakout didn’t occur yet) – this is visible for PREMIUM users only – the percentage of upward/downward breakouts that happened in the past. Because there can be both upward and downward breakout (i.e. there is an upward breakout, then the price reverses without meeting the target and the downward breakout occurs – so called pattern bust). In such cases statistics count the stronger of the two moves that occurred after breakouts. Another scenario is – no breakout at all (ATmatix tracks the chart pattern only for limited time after the breakout). That’s why these statistics don’t have to sum up to 100%.

- Target range/statistical pattern effectiveness – price target range computed after the breakout (usually two values). One of the values is based on the measure rule for the given pattern type (typically, adding the height of the pattern to the breakout level), and the second is based on the statistics of the past pattern performance. Because the subject is really broad and in the nutshell this is the most important part of ATmatix, we are going to write a separate blog post on this topic).

Given are also the absolute values (the target prices) and the expected percentage change in relation to the price of the breakout.

Statistical effectiveness is the percentage of the historical breakouts reaching at least the given level (for upward breakouts, the price should reach the given level or higher, for downward breakouts it should reach the given level or lower). This information is available for PREMIUM users only and it allows you to evaluate the chances for meeting the expected price level. - Volume trend – measures the volume change between the first and the last detected point of the pattern (it is computed for all the pattern points from the starting point till the day of its detection). This is the value calculated by applying the linear regression method and the trend is determined with a regression line slope. Usually, the theory states that in most cases the volume is decreasing during the pattern creation, but we’re going to describe our research on this matter in a separate blog post.

- The breakout price – the price, being a base of a post-breakout target calculation (breakout happens when the price pierces this level). It is a point on the trendline (or horizontal level) that limits the pattern (top line for upward breakouts, bottom line for downward breakouts).

- Breakout volume – the comparison of turnover volume on the day of the breakout with the average volume of 30 pre-breakout sessions. It is assumed that the breakout volume should be clearly higher, which increases the chance for a stronger post-breakout movement. We are going to research this matter more closely in the future. Volume information is available to PREMIUM users only.

- The throwback/pullback statistics and break even failure rates for a given pattern type.

CHART VIEW

Clicking the stock’s name in the “Ticker” column, or the name of the stock in the pattern details, opens the chart view. It is a modal window where you can find candlestick chart for the selected pattern and detailed information about the statistics, price targets and volume.This view allows you to browse consecutive patterns from the patterns table, using the hidden arrows in the left and right side of the chart. Those links are invisible and to enable them, you have to move the mouse pointer to the edge of the chart.

|

| The chart view |

It is also possible to use the arrow keys on your keyboard, to navigate between the patterns.

What is also worth mentioning, is the chart view respects the filters and sorting applied to the patterns table, so after switching to the chart view, navigation to the next or previous chart matches the content and sort order of that table.

Chart view may be closed by clicking the X icon in the upper right corner of the modal window, clicking outside the chart window or pressing ESC on your keyboard.

Just a few words about the content of the chart itself.

The horizontal axis contains the dates of the stock market sessions. The scale corresponds to daily intervals. The date range includes only the period in which the pattern occurred along with certain margins.

Vertical axis is the price value on a linear scale. The values of the turnover volume are placed in the background of the chart (as light gray bars) and are scaled so that the maximum volume value in the time period shown is at the top of the vertical axis. The absolute values of the volume are not shown.

The visualization of the pattern includes:

- Blue dotted lines connecting the detected pattern characteristic points (only for certain types of pattern),

- Green and red lines indicating the trendlines within the pattern – piercing these levels by the price result in upward or downward breakout. Horizontal price levels are shown as dotted lines. The levels narrowing the linear patterns such as: triangle, inverted triangles, wedges, inverse wedges, channels, etc. are shown as solid lines,

- Blue horizontal dotted lines denote target prices (if the breakout occurred).

- “near breakout”, when the price approaches the breakout level, is marked with a yellow arrow (after the breakout, this information is hidden, so as not to unnecessary complicate the chart)

- The breakout is marked with a green/red color arrow (green for upward breakout and red for downward breakout)

- Meeting the target price range (the pattern completion) is marked with blue color arrow. Upward pointing arrow indicates that the target price after a downward breakout was reached. Downward pointing arrow denotes the price target was reached after an upward breakout.

Labels: ATmatix , chart patterns , features , patterns table , usage